In our previous blogs, we have discussed about the origin of GST Law in India and the rationale behind the implementation of GST in India. We have also discussed the earlier Indirect Tax regime wherein various taxable events were present for different levies depending upon the nature of tax. The taxable events were also different and taxpayers were supposed to file multiple returns in terms of the provisions of Central Levies as well as respective State Government Levies. Under the current regime, “Supply” is a taxable event for the purposes of taxation.

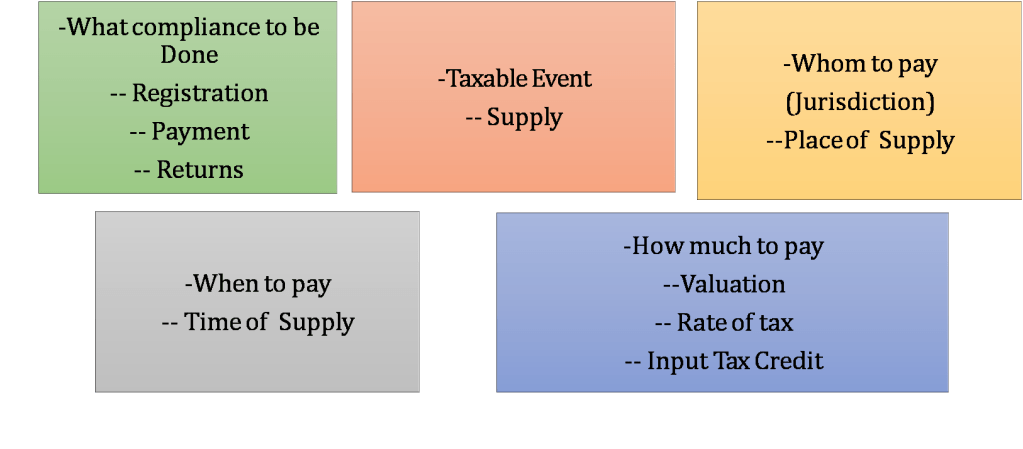

There are certain compliances, which are to be undertaken under the GST regime including but not limited to registration, availing correct Input Tax Credit, maintaining records, regular payment of taxes, filing of statutory returns etc. Therefore, we have summarized the broad framework of GST as under: