For the purpose of discharging GST liability, it is imperative to understand and know the date on which the tax liability arises i.e., the date on which the charging event has occurred. This concept is known as “Time of Supply” and it is a relevant measure under the GST law for every transaction entered into by the supplier of goods and services.

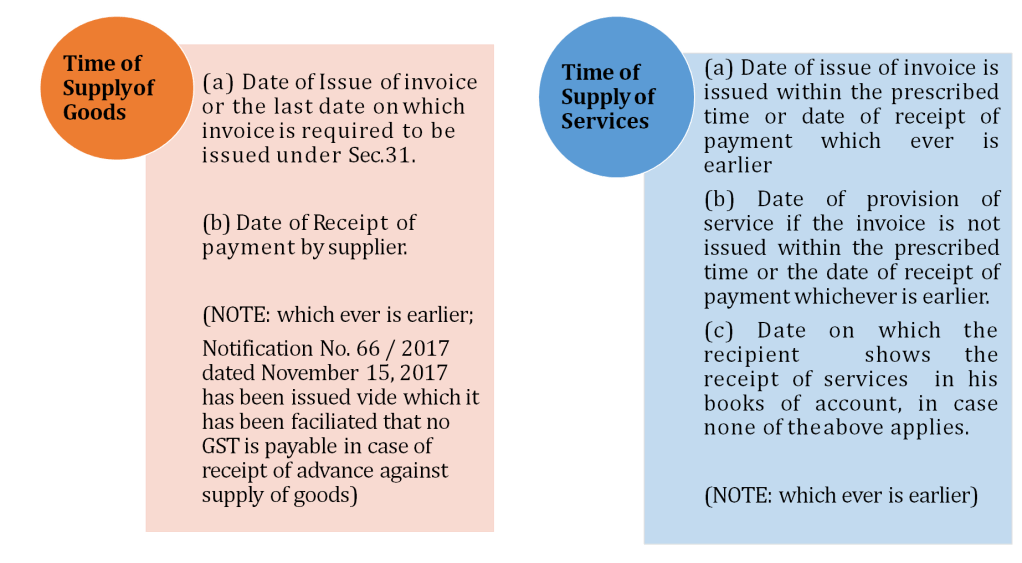

GST law has provided separate provisions for determining “The time of supply of goods” and “Time of supply of services”. Sections 12 and 13 of the CGST Act, 2017, deals with the provisions related to time of supply and by virtue of Section 20 of the IGST Act, 2017, these provisions are also applicable to inter-state supplies leviable to Integrated Tax.