Under the earlier Indirect Tax regime, various taxable events were present for different levies depending upon the nature of tax. The four major constituents of earlier Indirect Tax structure and taxable events thereof can be summarized as under:

- For Excise Duty– the taxable event was Manufacture / Deemed Manufacture, which can be seen under Entry Number 84 of List-I of Schedule VII;

- For Service Tax– the taxable event was provision of service, which can be seen under Residuary Entry Number 97 of List-I of Schedule VII;

- For Sales Tax/ VAT/ CST– the taxable event was sale, which can be seen under Entry Number 52 of List – II (State List) and Entry No. 92A of List – I (Union List) of Schedule VII;

- For Entry Tax / Entertainment Tax– the taxable events were entertainment and entry of goods, which can be seen under Entry Number 52 and 62 of List- II of Schedule VII.

GST (Goods & Services Tax) is a single tax that applies to the supply of goods and services from the manufacturer to the final customer. GST will effectively be a tax on the value addition at each level, with credits for input taxes paid at each stage from production to final consumption accessible at the succeeding stage of value addition. With set-off benefits throughout the supply chain under GST (seamless flow of Input Tax Credit between the manufacturer, wholesaler, retailer, etc.), the final price of the goods are comparatively low, unlike the previous tax regime where the dealer was unable to avail Cenvat Credit and CST Credit in case of inter-state supplies.

The following taxes have been subsumed at the Central level:

- Excise Duty (except certain exceptions);

- Service Tax;

- Central Sales Tax;

- Additional Customs Duty commonly known as Countervailing Duty;

- Special Additional Duty on Customs;

At the State level, the following taxes have been subsumed:

- State Value Added Tax;

- Entertainment Tax;

- Octroi and Entry Tax;

- Luxury Tax;

- Taxes on lottery, betting and gambling;

Even though majority of the indirect taxes have been subsumed under GST, still there are few taxes/ levies that have still remained active, post implementation of GST:

Central Level Taxes :

- Central Excise on Tobacco Products and Petroleum Products;

- Basic Custom Duty;

State Level Taxes:

- State Excise on Alcohol Liquor;

- State VAT on Alcohol Liquor and Petroleum Products;

- Stamp Duty;

- Electricity Duty;

- Profession Tax;

- Road Tax;

- Taxes on Mineral Rights;

Local Body Taxes:

- Property Tax;

- Entertainment Duty;

- Gram Panchayat Tax;

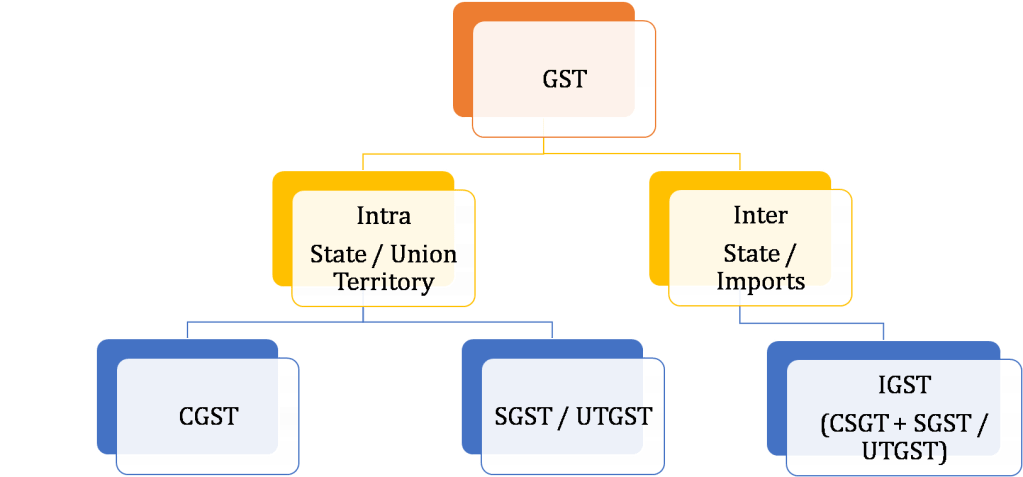

Tax Structure after GST: